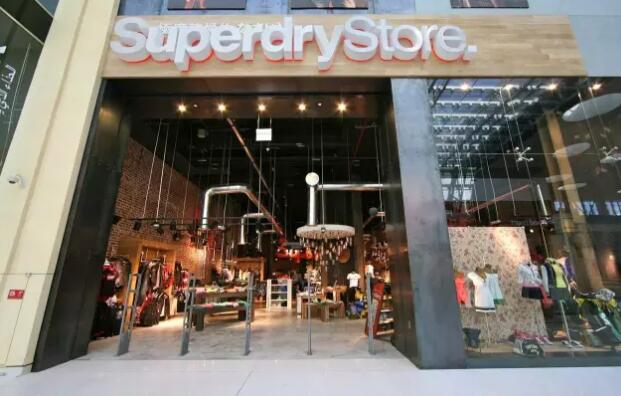

There were six luxury fashion brands that entered the $1 billion class for the first time last year, including Fendi, UGG, Dolce & Gabbana, Moncler and Valentino. With the continued recovery of luxury retail, the industry is now concerned about which luxury brands in the second and third echelons can stand out and sell revenues to the $1 billion club. There were six luxury fashion brands that entered the $1 billion class for the first time last year, including Fendi, UGG, Dolce & Gabbana, Moncler and Valentino. In the first half of this year, LVMH's fashion and leather goods division, including luxury brand Louis Vuitton, began to recover. Sales increased by 17.2% to 6.89 billion euros. Since LVMH never separately disclosed the specific sales of LV, some analysts expected it earlier. Louis Vuitton's annual sales are about 7 billion euros. Last year, Fendi's revenue exceeded 1 billion euros for the first time. After analysis, Céline and GIVENCHY will become the most potential brands of LVMH to enter the 1 billion club, and its Dior fashion. The department entered the 2 billion euro club as early as 2015. UGG has annual global sales of more than 1 billion US dollars. Currently, there are more than 137 fashion boutique retail and Ole stores in the world, and there are more than 1000 sales points in the world. In order to attract more Chinese consumers, UGG has officially announced that young film and television actors Yang Ying Angelababy became its brand spokesperson. This is the first time since UGG® was founded in 1978, the Chinese star has been the brand spokesperson. However, the brand parent Deckers Group's sales fell 4.5% year-on-year to $1.79 billion, while net profit plummeted 95.3% to $5.71 million. In June last year, Italian luxury brand Dolce & Gabbana revealed the development, production and distribution of perfumes, make-up and skin care products under the cooperation with Japan Shiseido Group. According to relevant data, in 2015 the brand's total retail sales of cosmetics and skin care products reached 440 million US dollars. In addition to the brand perfume business and wholesale business, the Dolce & Gabbana cosmetics line has annual sales of more than 500 million US dollars. Due to the closure of the D&G series by Dolce & Gabbana to simplify the product line, growth has temporarily slowed. However, Dolce & Gabbana's operating income still exceeded $1 billion last year. The company currently employs approximately 4,500 people and has 323 stores worldwide. In the 12 months ended December 31, Moncler's sales rose 18% year-on-year to 1.04 billion euros, in line with earlier market expectations, becoming another luxury brand with sales exceeding 1 billion euros. During the period, the Group's net profit increased by 16.6% year-on-year to 196 million euros, and the Group's profit before interest, taxes and depreciation increased by 18% year-on-year to 355.1 million euros. In the first half of this year, Moncler's sales increased by 18% year-on-year to 406 million euros, of which sales in the second quarter increased by 20%. This is the fourth consecutive quarter since the brand's listing in 2013. It recorded double-digit growth, net profit. It rose 25% to 41.8 million euros. The brand has a total of 191 retail outlets worldwide. After Maria Grazia Chiuri, one of the main designers of the brand, joined the French luxury brand Dior, Italian luxury brand Valentino first launched a separate fashion collection designed by another main designer, Pierpaolo Piccioli. Last year, brand sales increased by about 10% year-on-year. For the first time, it broke through 1 billion euros and reached 1.1 billion euros. In 2015, Valentino's turnover was 987 million euros, up 48% year-on-year. The luxury brand Bottega Veneta, which is undergoing transformation, recorded a decline of 8.7% last year, but still exceeded 1 billion euros, recording 1.173 billion euros. In 2015, the brand's revenue entered the 1 billion euro club for the first time. The brand has recovered from the fourth quarter of last year. In the first half of this year, Bottega Veneta's sales increased 2% year-on-year to 590 million euros, of which sales in the second quarter rose 2.3% year-on-year to 310 million euros. Footwear products have become Bottega. The main driving force behind Veneta's performance growth. In terms of categories, Levi's women's business, Coach men's business has reached $1 billion in sales last year, and YSL Beauty's revenue exceeded 1 billion euros for the first time. Michael Kors and Lululemon have said they will build a $1 billion menswear business. Here are a summary of the luxury fashion brands and groups that have the most potential to enter the $1 billion club: French luxury brand Céline, which has always been away from the Internet and social media, will usher in a turning point. Séverine Merle, the executive vice president of the Italian menswear brand Berluti, will be appointed to replace Marco Gobbetti as the new CEO of Céline. Séverine Merle officially stated that Céline will transform to digital upgrade, and the brand e-commerce platform will be launched as soon as the end of the year. Céline currently has great market potential in footwear and fine jewellery. The data shows that Céline's current revenue has more than quadrupled compared to 2008, with sales of EUR 800 million in 2016. The COS brand opened its first flagship store in Regent Street, London, UK in March 2007. In just a few short years, it quickly caused concern and consumption boom in the fashion industry. According to the fashion headline data, the brand is expanding on the scale of 22 new stores every year. According to relevant data, sales of COS have grown rapidly. From the year of 2009 to 2014, COS sales increased from $132 million to $625 million, nearly five times. The brand's sales this year are expected to reach 10 billion Swedish kronor of about 1.17 billion US dollars. SMC P Group, which owns fashion brands such as Sandro, Maje and Claudie Pierlot, achieved a sales growth of 16.4% in the fiscal year 2016 of 786 million euros. It is noteworthy that after Shandong Ruyi Group acquired control of SMCP Group for 1.3 billion euros last year, sales of Sandro, Maje and Claudie Pierlot in Asia increased by 45%. However, for 2017, the Group will remain cautiously optimistic and expects overall sales to enter the 1 billion Euro Club in 2019. Earlier there was news that SMCP planned to be in Paris IPO. It is reported that during the period of Riccardo Tisci's power, Givenchy has increased its brand size by more than six times. The current annual sales have reached 500 million euros, and the number of employees has increased from 290 in 2005 to more than 930. Clare Waight Keller, former creative director of Chloé, officially joined Givenchy as the new creative director on May 2nd, and is the first female creative director in the history of Givenchy. Givenchy CEO Philippe Fortunato said that Clare Waight Keller can inject some soft elements into the brand's dark style, saying that her mission is to take the 65-year-old Givenchy to a higher level. Benefiting from the depreciation of the pound, Super Group's annual sales rose 27.2% to 751 million pounds. Although the Super Group maintained its overall growth in the first half of FY2017, the growth rate has slowed down compared with the same period of last year. It is mainly affected by the negative impact of the global retail environment. North America and China are key markets for Superdry. Domestic women's Ou Shili parent company Herki International Group and British Supergroup announced the establishment of a joint venture company in September 2015, officially and comprehensively explore the domestic British clothing market. This cooperation was initiated and facilitated by the UK Trade and Investment Agency. The two parties invested a total of 18 million pounds, each holding 50% of each share, and the joint venture period is at least ten years. Annual sales are about 520 million US dollars, and the compound growth rate in the past three years has maintained double digits, which is expected to exceed 1 billion US dollars within three years. According to brand CEO Geoffroy de la Bourdonnaye, in the next few years, footwear products will be the key development area of ​​Chloé, and will cooperate with Onward Luxury Group to sign a 15-year distribution license agreement and develop the brand's own production line. It is expected that independent production will be achieved within a few years. Some analysts believe that Chloé's design may shift to a more modern style as the new creative director Natacha Ramsy-Levi prefers thicker fabrics such as fur. Furla achieved excellent growth in both turnover and EBITDA last year. During the period, Furla expects a turnover of 422 million euros. The current exchange rate will increase by 24.5% year-on-year and 22% under the fixed exchange rate. Group EBITDA almost doubled sales growth. This shows that Furla has the ability to grow both in terms of sales and gross profit. Lower prices, but with better quality and products to impress consumers, the Italian luxury brand Fula Furla has become the industry's largest dark horse in recent years, and Furla announced the launch of the IPO program in May last year. In the overall unstable situation of luxury retail, Longchamp still maintains its global market position. In 2016, Longchamp's turnover reached 553 million euros, which once again proved the brand's tenacity and popularity. It is worth noting that Asia, including China. The market has a 28% market share. The new store opened today at the Jing An Kerry Centre in Shanghai is one of the largest flagship stores in China. Longchamp's confidence and ambitions for the Chinese market are obvious. Longchamp Global CEO Jean Cassegrain said earlier on the fashion headline that Longchamp's growth rate averages 12 to 13% per year, so the calculation may be to enter the $1 billion club in five to six years. In December last year, the US clothing manufacturing and distributor G-III Group with a market value of less than 2 billion US dollars rushed 650 million US dollars to acquire DKNY parent company Donna Karan International from LVMH Group. However, for DKNY and Donna Karan two brands in 2016 In the sales performance of the year, Morris Goldfarb Morris Goldfarb, Chairman and CEO of G-III Group, said that he was not satisfied, saying that the brand product design was not commercial. He expects DKNY's products to be adjusted to sales of $1 billion over the next three to four years, while Donna Karan's sales will reach $500 million in five years. While most luxury brands are struggling, luxury cashmere brand Brunello Cucinelli has grown strongly against the trend. For the six months ended June 30, Brunello Cucinelli's sales increased 10.7% year-on-year to 243 million euros, in all regions. There has been an increase. Among them, the brand's sales in Italy increased by 5.9% year-on-year to 41.8 million euros; sales in other parts of Europe increased by 9.9% to 75.2 million euros; sales in North America recorded a growth of 9.4% to 83.6 million euros; in Greater China The increase was the most significant, with a year-on-year increase of 34.6% to 18.4 million euros. BALLY entered the Chinese market in 1986 and was the first luxury brand to enter China. It is currently controlled by the European investment group JAB Holdings. According to the data of the fashion headline network, the annual sales of the brand in FY2016 increased by 4%, the profit before depreciation and amortization increased by 100%, and the sales of wholesale channels increased by 20%, among which the tourism retail sector responsible for airport duty-free shops increased. The strongest, but the brand did not disclose the specific figures, but said that the brand's annual sales will enter the 1 billion euro club in 2021. At present, BALLY women's sales account for 37% of the overall business, and the brand CEOFrédéric de Narp said to the fashion headline network that it is expected to increase to 50% to 55% by 2020. In October 2015, designer Demna Gvasalia succeeded Wang Daren as the new creative director of Balenciaga. Subsequently, Balenciaga parent company Kaiyun Group announced in October last year that YSL original product and marketing director Cédric Charbit took over Isabelle Guichot as the brand CEO. Balenciaga is the largest brand in the other categories of luxury brands in the Kaiyun Financial Report, accounting for about 20% of sales in this category. Analysts expect that the current sales of the Balenciaga family are about $500 million, which has been continuously gained in social media in recent years. A large number of exposures still have great market potential. Charbit's main mission after taking office is to accelerate the globalization of the Balenciaga brand. British luxury footwear brand Jimmy Choo benefited from the strong performance of the brand in the Asian market and men's footwear category for the 12 months ended December 31, 2016. The annual sales increased by 14.5% year-on-year to 364 million pounds. Data show that, driven by the Asian market, men's shoes have become the fastest-growing category of Jimmy Choo, with footwear accounting for 75% of total sales. In addition, the license agreement between Jimmy Choo and Safilo was extended to 2023, and men's sunglasses are planned to be launched in 2018. In July of this year, Michael Kors announced the acquisition of Jimmy Choo for $1.2 billion. Some analysts said that Michael Kors' extensive retail network synergy will drive further growth of Jimmy Choo. In the 12 months ended December 31, 2016, Italian luxury goods group Versace sales increased by 3.7% year-on-year to 669 million euros, while profit before depreciation and amortization plummeted 45% year-on-year to 44.3 million euros, and recorded a net loss. 7.4 million euros, while Versace's net profit for the fiscal year 2015 was 15.3 million euros. The brand said that although losses were recorded during the period, sales of all its product categories and channels increased, especially in the Asia Pacific region. As of the end of the reporting period, Versace has a total of 200 direct stores worldwide, which has become the main engine of brand growth. In 2014, Blackstone acquired a 20% stake in Versace from Giaps Holding SpA for €150 million, and the remaining 80% was held by the Versace family. After the transaction was completed, Blackstone Group said it planned to let Versace go public within three to five years. Alexander McQueen said it will increase its brand-operated stores to 90 in the next three to four years and increase its retail channel revenue share from 36% last year to 54% of total sales. By category, women's ready-to-wear is the brand's largest sales revenue category, accounting for 38%; followed by 20% of leather goods and 15% of men's collections. In fact, the Chinese have always been the largest customer base of this British brand, accounting for 32% of global sales. Among the other luxury brands in the Kaiyun Financial Report, Alexander McQueen accounted for 15%, and analysts speculated that Alexander McQueen had an annual income of about 300 million euros. Editor in charge: Wang Zhen Rubber Bushings, usually called Rubber Sleeve Bearing, Rubber Sway Bar Bearing, Rubber Damper,Rubber Flange Bearing, Rubber Plain Bearing,etc, is a fixed or removable cylindrical lining used to constrain, guide, or reduce friction toprotect an inside surface, which is known as an insulating lining for a hole through which a conductor passes and an adapter threaded to permit joining of pipes with different diameters.often with screws. Custom Rubber Bushing,Rubber Energy Bushing,Bushing For Auto Parts,Parts Suspension Bushing Xiamen The Answers Trade Co.,Ltd. , https://www.xmanswerss.com

October 08, 2023